Energy efficiency financing has grown more than 40% since 2014, reaching at least $7 billion annually, but it will need to increase significantly more to achieve urgent climate goals, according to an ACEEE analysis released today. This financing—in addition to grants, rebates, and other incentives—will enable a robust scaling of the energy-saving investments that are vital for reducing carbon emissions, improving equity in energy affordability, and spurring job creation.

Our analysis estimates that five major types of energy efficiency programs are responsible for nearly $7 billion in annual lending:

- Commercial and Residential Property Assessed Clean Energy (C-PACE and R-PACE)

- State energy office (SEO) revolving loan funds (RLFs)

- On-bill financing (OBF), on-bill repayment (OBR), and tariffed on-bill financing (TOB)

- Utility financing programs (in which loans are not paid back on-bill)

- Energy savings performance contracting (ESPC)

This represents growth of more than 40% since 2014, the most recent year for which we have comprehensive lending volume data from these programs. Our research builds on Lawrence Berkeley National Laboratory’s 2016 technical brief Energy Efficiency Program Financing, which until now was the most recent assessment of efficiency financing. Our lending estimates are informed by data sourced from more than 120 financing programs via publicly available data and from direct outreach to program administrators, as well as market estimates for ESPC volume.

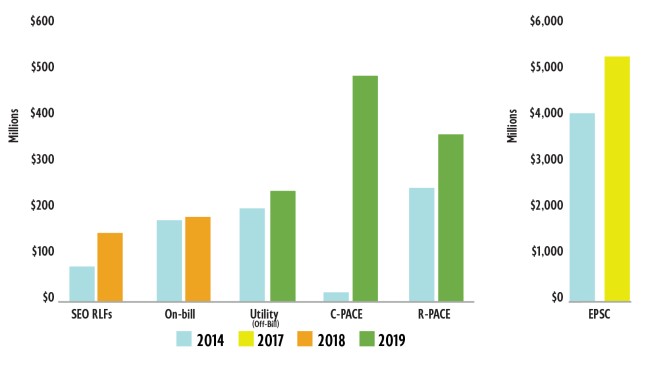

As shown in the chart below, energy efficiency lending has increased since 2014 across all programs covered in this research.

Annual programmatic energy efficiency lending volume. The scale on the right is for energy savings performance contracting (ESPC) data only; the scale on the left is for the remaining five programs. Source: 2014 numbers reported from LBNL’s Energy Efficiency Program Financing. Note that recent data vary in timeframe, hence the need to use 2017, 2018, and 2019 data.

The largest and most robust programs we analyzed leverage primarily private capital sources to fund their loan portfolios. For example, Massachusetts’ Mass Save HEAT Loan program uses a network of nearly 100 local lenders to fund its nearly $160 million in energy efficiency loans.

The estimated $7 billion in annual programmatic financing for efficiency investments reflects a meaningful increase compared with prior years. While this growth is encouraging, financing needs to increase at least tenfold (to at least $70 billion) to ensure we make the efficiency upgrades necessary to help reach our climate and decarbonization goals. Energy efficiency investments are the most cost-effective way to reduce energy use. Building efficiency also creates a healthier indoor environment for occupants. Effective financing is essential if we are going to mitigate the upfront costs of implementing such improvements.

We would like to thank our friends at the Lawrence Berkeley National Laboratory (LBNL), PACENation, the National Association of State Energy Officials (NASEO), the Environmental and Energy Study Institute (EESI), and program administrators across the county for helping us procure all the data required to make this research possible.