New York State has been a leader in utility of the future efforts and embarked on a major initiative to change how it regulates energy utilities, called Reforming the Energy Vision (REV). In a blog post earlier this year, I described a major decision in the REV proceeding before the state’s Public Service Commission (PSC), and also raised some questions about the role of energy efficiency as REV moves forward.

Energy efficiency programs under REV

Under REV, the role of utilities in implementing energy efficiency efforts increases as programs operated by the New York State Energy Research and Development Authority (NYSERDA) transition largely to an upstream focus on market transformation and improving the functioning of markets for clean energy. The PSC decision early this year set 2016 energy saving goals for utilities at the same level as their 2015 goals, but stated that “longer-term goals should exceed existing targets.” In our opinion, higher targets are needed, because in recent years (e.g., 2014) NYSERDA programs have saved more energy than the utility programs. With NYSERDA changing its focus, the expanded utility programs should, at a minimum, include the savings that NYSERDA programs previously achieved. The PSC asked the utilities to prepare three-year energy efficiency plans, and for NYSERDA to describe its plans in more detail. These plans were all filed in July and this blog post summarizes ACEEE’s initial review of these plans.

Energy efficiency plans range from strong to weak

Overall, the utilities' various plans are a mixed bag. On the positive side, National Grid, the state’s second largest investor-owned utility, proposed a plan that will achieve electric efficiency savings of about 0.9% of their distribution sales in their first year and ramp up to 1.2% of sales in the third year (these calculations are ACEEE’s as described below). National Grid’s New York savings are substantially greater than the other New York utilities, but still fall short of the greater-than-2.0%-per-year savings that National Grid is achieving in Massachusetts and Rhode Island.

NYSERDA also proposed an extensive series of programs including both new “market development initiatives” and continuance of some existing programs through a transition period covering 2016, and in some cases (e.g., for multifamily buildings), through 2017. Some notable new initiatives address the energy efficiency of tenant spaces in commercial buildings, strategic energy management in industrial facilities, zero net energy and deep retrofits in both the residential and commercial sectors, and efforts to help prospective residential tenants and home buyers to assess the energy efficiency of a home or apartment before they sign a lease or contract. Also noteworthy, relative to earlier proposals, NYSERDA provides fewer funds to the New York Green Bank in the short term and instead shifts some of those funds to the latter years of the plan. The Green Bank already has hundreds of millions of dollars set aside and will not need additional capital for a while.

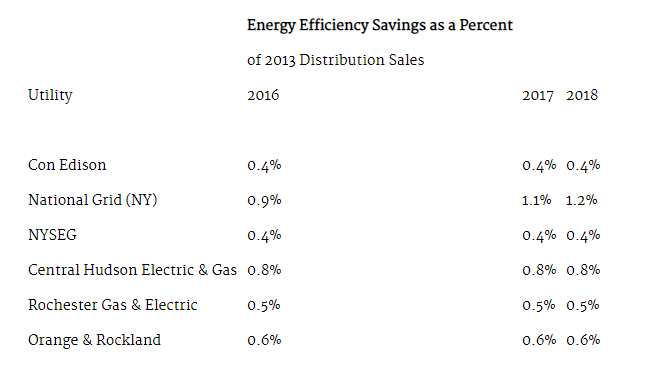

The plans of the state’s other large utilities, Consolidated Edison (Con Ed) and New York State Electric & Gas (NYSEG), are not as promising. Con Ed’s plan calls for energy efficiency savings of about 0.4% of distribution sales in all three years, while NYSEG’s plan also targets savings of about 0.4% of distribution sales. Both the Con Ed and NYSEG plans include only a limited number of programs with a focus on commercial and industrial rebates, small commercial direct installation, and multifamily programs. In between, with savings of 0.5-0.8% of distribution sales, are the state’s other investor-owned utilities. These percentage savings calculations are shown in the table below for all of New York’s investor-owned utilities.

Source: ACEEE calculations of percentage savings targets using planned savings in individual utility plans and calculating these as a percent of 2013 electricity sales by utility as reported by the US Energy Information Administration (http://www.eia.gov/electricity/data/eia861/). Our electricity sales numbers include both bundled sales (utility procures power) and delivery sales (customer procures power and utility delivers it), but for each utility we deduct a pro rata share of sales by the New York Power Authority (NYPA) since NYPA offers its own energy efficiency programs to its customers and therefore NYPA customers are not served by the other utility programs.

PSC needs to set more explicit targets

Based on ACEEE’s review, only National Grid is following the PSC’s desire to increase their energy saving targets over time. We recommend that the other utilities also follow this guidance and plan a steady expansion of their energy efficiency programs.

Most importantly, if the PSC wants the other utilities to increase their energy efficiency savings, they will need to be more explicit in setting new targets and not just letting the utilities base their energy savings targets on past achievements. In addition, our review of the utility plans indicates that transition plans are needed for some important NYSERDA programs that will be ending as NYSERDA shifts focus. Again, the PSC should specifically request such transition plans from the utilities, such as new construction programs, and multifamily and single-family retrofits. National Grid is proposing a new construction program, but such programs are not mentioned by Con Ed or NYSEG. New construction programs are particularly important because it is generally much less expensive to build efficiency into new construction than it is to build an inefficient building and have to retrofit it later. All three utility plans mention multifamily programs, but none provide any detail on how comprehensive these will be. National Grid appears to be planning a single-family program, Con Ed is unclear, and NYSEG does not appear to have such a program in their plans.

In addition, the next phase of the REV proceeding will be very important. In this phase, the PSC plans to move toward performance-based ratemaking, where utilities will be measured and rewarded based on several performance metrics. In late July, the PSC staff released a white paper on these issues. We will comment on this new white paper in a future blog post, but for now just note that it includes performance incentives for meeting energy efficiency targets, seemingly using the modest targets contained in the utility plans.

New York has been a leader on energy efficiency for decades, finishing as high as third in ACEEE state energy efficiency scorecards over the past nine years. National Grid and NYSERDA appear to be continuing this leadership tradition. Both the PSC and the other utilities will need to step up their energy efficiency efforts in order for New York as a whole to continue being an energy efficiency leader.