This is the fourth and final blog post in our series on recent developments in energy efficiency financing. Prior posts covered Energy Service Agreements, PACE Financing, and on-bill finance.

Deep retrofits to existing buildings will be critical for reducing energy use and greenhouse gas emissions over the next 30 years. But such retrofits can be expensive, so financing is vital for unlocking energy savings. Several recent projects illustrate innovative ways to finance these retrofits.

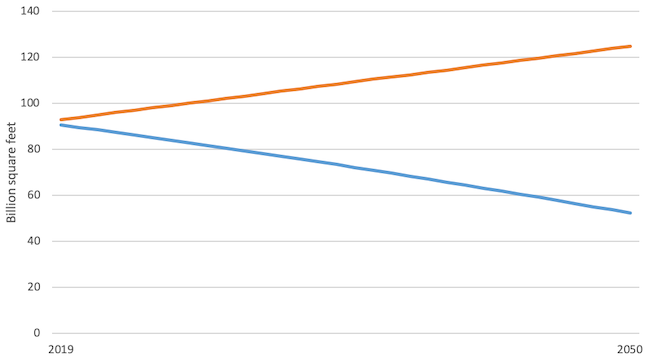

In 2050, roughly half the US building stock will be buildings that are standing today (see figure below). Yes, we can and should build new buildings well, but we will also need to substantially reduce energy use and emissions from existing buildings. Typical building retrofits reduce energy use by 10-25%, but deep retrofits save at least 30%, sometimes more than 50%.

Government projects use ESPCs

The US government is using one kind of financing tool for deep building projects – Energy Saving Performance Contracts (ESPCs). With ESPCs, an energy service company (ESCo) designs projects, finances them, and oversees both their initial installation and ongoing maintenance. The ESCo is paid based on the actual energy savings. The General Services Administration (GSA) used ESPCs to finance deep retrofits on seven buildings across the United States, achieving an average energy use reduction of 58%.

In the GSA effort, a different energy service company was involved in each project. The projects typically involved major building renovations. To finance deep retrofits, energy performance contract terms were typically 25 years, the longest permitted for federal government projects. In one example, a comprehensive retrofit of a federal office building in New Carrollton, MD, the retrofit included a new central chilled water plant, integrative building controls and sensors, geothermal heat rejection, an exhaust to outdoor air heat recovery loop, LED lighting, and an 808 kW solar PV array that together reduced building energy use by 60%. The ESCo (Ameresco) invested a total of $40 million and estimates energy savings to be $2.5 million per year. A key component of the project was to reduce building loads, allowing the chiller to be downsized by 40% relative to the pre-retrofit system.

A report on the seven GSA projects identified six retrofit lessons:

- Set aggressive long-term goals.

- Engage and collaborate with diverse stakeholders.

- Establish a support system.

- Start with a clean sheet and a beginner’s mind.

- Use an iterative, holistic design process.

- Incorporate feedback and ongoing involvement.

Johnson Controls tries various financial models

More recently, Johnson Controls International (JCI), one of the United States’ largest ESCos, has undertaken deep retrofit projects with several large institutional customers, including the Hawaii Department of Transportation, the University of Hawaii Maui, Samford University (a private university in Alabama) and the city of Evansville, IN. These projects all involved integrated packages of measures that together reduced energy use by 32-45%. All involved 20-year ESPCs, but in some cases, they used innovative financial models to serve unique project needs.

These include:

- Power purchase agreements: The University of Hawaii agreed to purchase power from an on-site solar project developed by JCI and a utility partner.

- Contingent payments: Samford University payments are contingent on measured savings.

- Tax-exempt lease purchase: The municipality of Marquette, MI, pays for infrastructure improvements through annual lease payments paid through savings.

- Public-private partnership agreement: The University of North Dakota and JCI created a partnership for a 40-year design-build-operate-maintain central plant project.

These examples pertain to commercial buildings, but another company, Sealed, has other plans. As ACEEE discussed in a recent blog post on energy service agreements, Sealed is hoping to combine utility incentive programs with energy service agreements for deep retrofits of single-family homes.

Given the importance of slashing energy use and emissions, additional financing strategies for deep retrofits are likely to develop in the coming years. ACEEE plans to keep abreast of and report on these developments.

Read other items in ACEEE’s series on recent developments in energy efficiency financing: Energy Service Agreements, PACE Financing and on-bill finance.