Looking for an investment with a high, secure return on investment? A light energy efficiency retrofit of a typical existing home can deliver a whopping 18.5% return annually, nearly double that of long-term stocks. It’s also a much higher return than that of residential rooftop solar, though they both deliver complementary cuts in carbon emissions that are necessary to address the climate challenge.

Ideally, homeowners will combine energy efficiency and solar, using the former to reduce energy demand and improve comfort, and then adding the latter to serve the now-smaller power load. If their budget is limited, though, homeowners will often get a bigger bang for their buck by prioritizing efficiency. We documented this finding in a recent blog post and paper by ACEEE’s Chris Perry about new home construction.

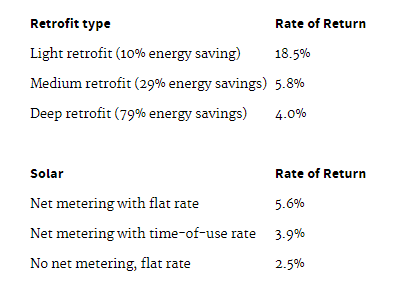

In today’s post, we explore the economics of efficiency and solar for an average existing home. We find that a light efficiency retrofit, which reduces energy use by 10%, has the best return on investment. A medium efficiency retrofit saves more energy (29%), but because of its higher cost, has a lower return. Its return is similar to that of solar with net metering at a fixed rate — that is, when homeowners sell the excess electricity generated from their rooftop arrays back to the grid at a fixed retail power price.

Not surprisingly, a deep efficiency retrofit saves the most energy but takes longer to pay back. Its return is similar to solar with net metering and typical time-of-use rates — when homeowners sell their excess power back to the grid at a rate that varies based on time of day. (They often earn less from their solar with a varying rate than a flat one.)

We based our analysis on the energy use of an average American home that uses about 11,500 kWh of electricity and 400 therms of natural gas each year. For solar, we use St. Louis weather, which is about average for the United States. Our costs and savings for the light retrofit, which includes sealing air leaks and other low-cost efficiency measures, are based on the Connecticut Home Energy Solutions program. For this retrofit, the annual energy savings are worth $185, providing an 18.5% annual return on the $1,000 retrofit cost. Additional details on the assumptions, calculations, and sources can be found here.

This rate of return is much better than the approximately 2% annual return paid by banks or money market funds and nearly double the approximately 10% long-term returns by the stock market.

Rates of return on various efficiency and solar investments are summarized in the table below:

We based our medium efficiency retrofit on a US Department of Energy study of comprehensive home retrofits in New Jersey. The study’s average retrofit cost is about $14,000, including new furnaces and air conditioners that would have to be replaced eventually. To account for this, we applied a discounted credit of $5,600 for the value of this avoided replacement, five years in the future. After this credit, the return on investment is 5.8% per year – better than the bank and lower risk than the stock market.

Our deep efficiency retrofit, based on the Vermont Zero Energy Now program, achieves 79% average energy savings (sometimes including solar) at an average cost per home of $41,200. (Because this includes HVAC, we applied the same credit for future replacement). The return on investment, 4.0% per year, is double what a bank will pay. But if a home renovation occurs at the same time, the combined costs can often be reduced and efficiency’s rate of return increased.

Turning now to solar, we look at an 8.23 kW system – enough to serve the annual electricity use of our average US home, based again on St. Louis solar conditions. This system costs about $26,600 without a battery backup. We don’t include solar incentives, just as we didn’t include efficiency incentives. We also note that the residential federal solar tax credit is due to expire soon. With net metering at the US annual average electricity price of nearly 13 cents per kWh, the system saves $1,480 per year for a 5.6% return on investment. This is similar to the return on the medium efficiency retrofit.

But if the net metering is based on time-of-use rates, the annual system savings decline, because daytime power can be worth less than evening power, which is more in demand. (Hawaii now uses these variable rates, and other states are starting to do so, as well.) Under this type of net metering, the value of net metering declines by more than $600 per year in Hawaii, but by about $440 in the United States overall, adjusting for differences in power prices and energy use. This reduces the return on investment to 3.9%, not quite as good as the return on the medium efficiency retrofit.

And if there is no net metering and excess power is sold back to the utility at 4.5 cents per kWh (a typical utility avoided cost), the solar systems save about $547 per year, a 2.5% return on investment, similar to the bank and not quite as good as the deep retrofit.

We base our analysis on US averages. Energy use, energy rates, solar insolation, fuel mix, and solar costs vary widely among regions and homes. We recommend additional analysis to cover a much wider range of conditions. But this simple analysis suggests that light efficiency retrofits are likely to make sense for most homes and that medium efficiency retrofits and solar with net metering make sense for many homes. We also find that the existence and type of net metering can have a substantial impact on the rate of return for solar investments. In addition, we find that deep retrofits may make more sense when done as part of larger home renovations than as energy-only projects. Lastly, efficiency and solar are nice complements; reducing loads with efficiency and then serving remaining loads with solar can maximize cost savings and greenhouse gas reductions.