If you spend any time with the energy efficiency crowd, you will often hear us call it the lowest cost energy resource out there. What you will never hear us say is that energy efficiency is free. Efficiency can do many great things: It saves money, cuts pollution, increases productivity, and creates jobs. What it can’t do is defy one of the fundamental laws that governs all investments—it takes money to make money.

We want to get money flowing into well-designed energy efficiency projects, especially those that can do the most good where it is the most needed, but that’s not as easy as it sounds. It can be particularly challenging to attract investment in low- and moderate-income communities. Buildings in low- and moderate-income (LMI) communities are often older and have outdated and aging materials and equipment that leave lots of room for efficiency improvement. So we look at these buildings, we see a lot of low-hanging fruit, and we think that there should be a way to invest in them. But we’re not sure if we can.

A few years ago, Bank of America decided to test the proposition. Bank of America works with Community Development Financial Institutions (CDFIs), nonprofit loan centers that focus on LMI neighborhoods, to help invest in the communities they serve. In 2011, they launched their Energy Efficiency Financing Program to provide up to $55 million of low-cost capital to CDFIs for energy efficiency and other clean energy loans. The Bank of America Charitable Foundation also provided $5 million in grants to help CDFIs offset the administrative costs of running their programs. Bank of America teamed up with Bright Power to track pre-retrofit and post-retrofit data so that the results of the program could be analyzed, and they asked us to take a look at the results of the program. Today, we’re releasing a report on our findings, that gives a detailed analysis of the results of their efforts.

The aim was to help CDFIs scale up successful existing programs and support promising new pilots, as well as to create jobs in the post-recession economy. Bank of America also sought to find out if the savings from energy efficiency investments were sufficient and stable enough for this to be a viable financial market.

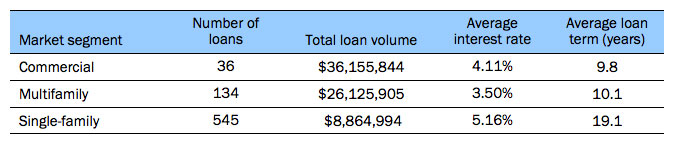

In total, the CDFIs loaned out more than $70 million, which included additional funds from other sources. The loans were used for efficiency upgrades, solar panel installations, and conversions from heating oil to natural gas. In many cases these were done in conjunction with other repair or upgrade projects. The table below gives a summary of the loans that were made.

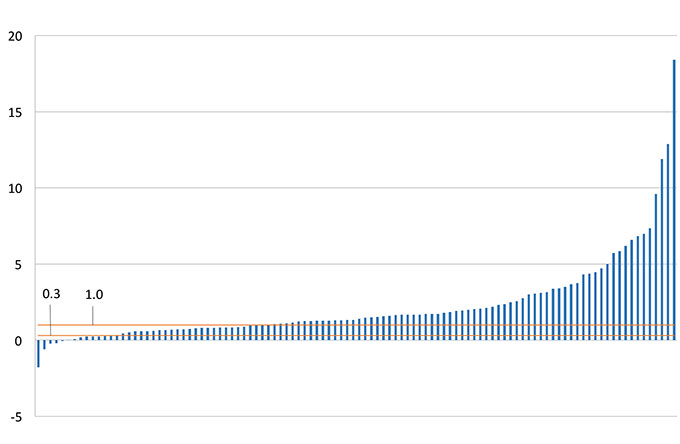

Looking at the data both on the loans and the buildings themselves, we found the results to be fairly strong. For individual buildings, we calculated a projected Savings to Investment Ratio (SIR) for the subset of buildings for which we got energy data. The SIR compares the present value of the lifetime savings that the energy measures should provide to their upfront costs (excluding the costs of any non-energy measures). The figure below ranks the buildings in terms of SIR from lowest to highest. Buildings with SIRs of over one have measures that will more than pay for themselves over their useful life. We also looked at a threshold of 0.33. Because high-efficiency equipment typically costs no more than 50% more than similar equipment of average efficiency, a project that generates enough savings to cover 33% of the its total cost is probably saving enough to cover the extra expense of the high-efficiency equipment. This means that for projects that involve replacing old equipment, a SIR of .33 should be enough to justify the extra expense of more efficient equipment.

As you can see, the buildings fared pretty well. Some did extraordinarily well, returning over 10 times the cost of the upgrades. Others did just OK, and a couple actually had negative SIRs, which means they consumed more energy after the upgrade than before. This is probably due to entirely unrelated reasons, like the addition of a family member to a household or a change of operating hours for a business.

The loans that financed the upgrades did well, too. At the time of reporting, 1.2% of the loans by original volume were 30 days past due and 0.7% were in default. These numbers likely understate the success of the program because even if a loan goes into default, some of it has already been paid back. In speaking with the CDFIs, they felt confident that most of these loans would eventually be brought back into good standing.

The program was successful on two levels. First, as the chart shows, the upgrades performed on the buildings in our sample saved quite a bit of energy, and in most cases, it was more than enough to cover their costs. In our discussions with the CDFI lenders, it was clear that relying on existing or new partnerships with experienced efficiency implementers was key. Energy is not usually at the top of people’s minds, whether they own an apartment building, a business, or their own home. The programs were most effective when CDFIs, who know the owners and often already have them as customers, partnered with energy experts who could design and implement effective upgrade projects.

Second, the loans have also been successful, and the portfolio is performing well. This is due in part to strong partnerships between CDFIs and Bank of America. Bank of America created a flexible loan program CDFIs could shape to the needs of their customers. With that capital and flexibility, CDFIs, in turn, leveraged their knowledge of the local community to invest in energy efficiency projects that will have long lasting impacts.

Of course, our data is not exhaustive, and these results don’t guarantee that projects like these will always perform well. At the same time, for building owners, CDFIs, and large investors, we see good news here. Homeowners and building owners can clearly save money investing in efficiency, and CDFIs can include energy efficiency in their mission to serve economically challenged communities. For large banks, this is clear evidence that it is possible to design financially viable efficiency-lending programs that could help solve the problem of how to attract investment dollars to help generate energy savings. Finally, this is good news for energy consumers everywhere. As the efficiency market continues to mature and key financial institutions learn how to make it part of their business model, we will see more and more investment in efficiency for homes and businesses, bringing the savings, job creation, pollution reduction, and other benefits of energy efficiency to a steadily broadening audience.