Electric vehicle sales grew 65% last year, with nearly all the growth coming from surging purchases of light-duty passenger EVs. Mitigating climate change will require vehicle electrification among a broader range of automobiles. Heavy-duty vehicles, like tractor trailers, are only 10 percent of vehicles on the road, but they are responsible for 28% of U.S. greenhouse gas emissions from the auto sector, showing that electrifying tractor trailers (also called big rigs, semis, or 18-wheelers) is a critical challenge that must be addressed.

Passenger vehicle and bus electrification steadily growing

In 2022, fully electric vehicles comprised 5.8% of the new car market in the United States, a record high, with plug-in hybrids adding about 1.4% of vehicle sales. A New York Times article headlined “Electric Vehicles Could Match Gasoline Cars on Price This Year” reported that prices will likely continue trending lower, fueling rapid EV growth. Pickup trucks were a challenge in the past, but Ford’s EV F-150 Lightning has about 200,000 orders, and Chevrolet and other companies are bringing additional EV pickups to market.

Delivery vans are also starting to go electric, with Amazon now using more than 1,000 of the vehicles and UPS, FedEx, and Walmart placing major orders. More than 12,000 electric school buses are on the road or on order, aided in part by funds from the 2021 bipartisan infrastructure law. Likewise, public transit buses are steadily electrifying, with California, New York City, the Washington, DC region, Pittsburgh, and Phoenix making commitments to zero-emission fleets by 2040 or 2045. Even for garbage trucks, lower operating costs and reduced noise led Waste Dive to headline an article “Electric Evolution Increasingly Seen as Inevitable for Waste and Recycling Fleets.”

Robust EV sales are aided by new federal tax credits that began January 1, with credits up to $7,500 for passenger vehicles, and 30% of purchase price (up to $40,000) for commercial vehicles. In all of these market segments, much work remains to be done—the vast bulk of auto sales are still gasoline and diesel vehicles—but EVs have momentum.

Heavy-duty electric truck market is tiny but starting to grow

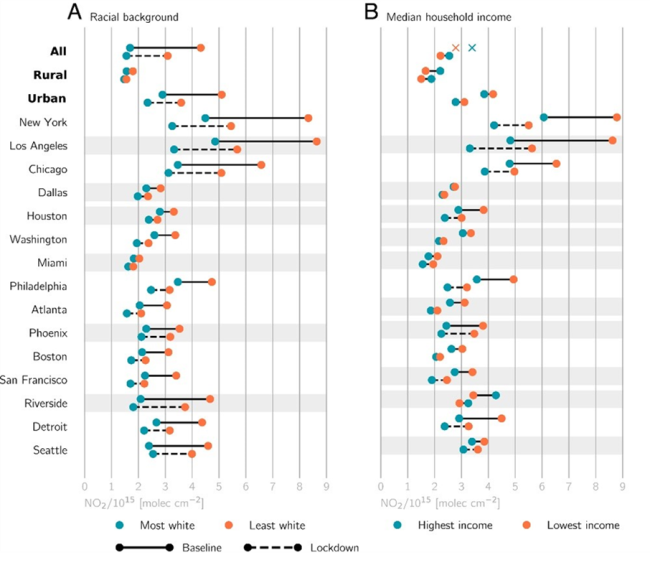

The heaviest trucks on the road, like 18-wheelers and cement trucks (called class 8 trucks), account for 14% of retail truck sales. Another 3% are slightly lighter heavy-duty trucks, like transit buses and garbage trucks (called class 7 trucks). Though together they’re less than a fifth of the trucks on the road, class 7 and 8 trucks account for 62% of truck energy use and a somewhat higher percentage of truck carbon dioxide emissions. Heavy-duty trucks contribute 28% of climate pollution from the auto sector despite representing only 10% of vehicles on the road, and they are also responsible for 45% of on-road nitrogen oxide (NOx) emissions and 57% of on-road, direct PM2.5 emissions (particulate matter less than 2.5 micrometers in diameter), according to data compiled by the Union of Concerned Scientists. NOx and PM2.5 cause significant health risks. Because interstates and other truck routes frequently cut through communities of color and low-income communities, the highest concentrations of these pollutants are often found in those communities, as shown in the figure below, which was compiled by MIT researchers using sensor data from satellites.

Disparities in baseline and COVID lockdown NO2 columns for different (A) racial and (B) median household income subgroups. Source: Kerr et al., 2021, Proceedings of the National Academy of Sciences.

Given their high emissions and that big rigs are more likely to be routed through low-income areas, electrifying heavy-duty trucks (and thus reducing their on-street emissions to essentially zero) is both a climate and environmental justice issue.

Volvo and Freightliner have started commercial production of electric semis, following several years of real-world use of pre-production vehicles. Tesla has started delivering vehicles to customers and expects to move into commercial-scale production this year. Several other companies are also in product development, testing, and initial deliveries.

Volvo is furthest along and has sold 51 semi-cabs as of October 2022, accounting for the majority of electric semi sales so far in North America. Volvo’s VNR electric trucks are produced at a factory in Virginia and are sold with a full-service package covering basic and preventative maintenance. The VNR truck can go up to 275 miles on a charge, making it good for day use and returning to its base by night for recharging. Volvo has been the #3 class 8 manufacturer in the United States but is hoping its electric rigs will allow it to increase its market share.

Freightliner (owned by Daimler) has been the #1 U.S. class 8 manufacturer and has been testing 30 EV rigs with customers for several years. Based on this experience, Freightliner developed a second-generation version of its eCascadia truck. This new model can go about 230 miles on a charge. Freightliner has orders for more than 700 trucks and plans to fill the orders from its Portland, Oregon area factory in 2023.

Tesla is the newest entrant to the electric heavy-duty truck field. It has been road-testing its electric semi for several years and recently delivered 36 trucks to Pepsi. Tesla announced it is setting up a factory near Reno, Nevada with a capacity to build 50,000 of the trucks a year. Tesla’s semi comes in two models, one with a 300-mile range and another that can go 500 miles on a single charge. The latter can be used for longer-haul routes but will require the availability of a charger at the end of its run.

In addition to these three leaders, Pacar, currently the #2 U.S. manufacturer of class 8 trucks, is testing and taking orders for electric models under its Peterbilt and Kenworth brands. Lion, a Canadian manufacturer, and BYD, a Chinese firm, are also entering the U.S. market, as is startup Nikola.

A compilation by analyst Brian Wong estimates that most of the electric semis from Volvo, Freightliner, Peterbilt, and Kenworth are selling for about $400,000 to $500,000 each, with prices varying based on a variety of factors, including the availability of local incentives. Lion, BYD, and Nikola are reportedly in the $300,000 to $400,000 range. In 2017, Tesla said it would sell its trucks for $150,000 to $180,000, but it has not announced exact pricing. In comparison, a diesel semi sells for about $130,000 to $160,000.

Opportunities and challenges ahead

Electric 18-wheelers are now entering full-scale production, and the number on the road will grow substantially this year and next. Initially these trucks will mostly be used for short-haul routes, such as from a port to a warehouse, with some regional hauling (out and back in a single day).

Shorter routes account for a substantial majority of truck miles driven, with about 77% of class 7 and 8 truck trips under 200 miles and only about 13% of trips more than 500 miles. Long-haul electric truck use and reliability will depend on the development of charging infrastructure at truck stops and on bringing additional long-haul models to the market.

Some states provide incentives for electric semis, such as California (up to $120,000) and New York (up to $185,000). However, these levels of incentives are designed to help the market get started and not for the long term. The new federal tax incentive covers 30% of a vehicle’s cost, but the tax credit is capped at $40,000 per vehicle. This cap is too low for class 8 vehicles—using $400,000 as a typical cost (the approximate midpoint for the data discussed above)—the $40,000 cap will only cover 10% of vehicle cost. We recommend that Congress double the present cap to $80,000 for class 8 vehicles through about 2030. A recent study by the International Council on Clean Transportation found that the battery pack is often most of an electric truck’s cost, and the study estimated that as battery costs come down, electric semi-cab costs will be reduced by about 23% in 2025 and 40% in 2030. A higher tax incentive until 2030 would help address initial high costs but phase out as prices decline.

In addition to incentives, ambitious vehicle efficiency standards would help the market mature. The Environmental Protection Agency is preparing to release the next round of greenhouse gas emissions standards for medium- and heavy-duty vehicles and will need to ensure that the model year standards reflect accurate data on vehicle sales and projected EV penetration in the relevant vehicle sectors. Additionally, setting stringent standards will help drive the production and availability of heavy-duty EV trucks. The EPA’s new greenhouse gas standards should acknowledge the impact of new federal tax incentives for heavy-duty trucks, the ambitious steps that states are taking to drive vehicle electrification (such as California’s Advanced Clean Trucks and Advanced Clean Fleets rules), and manufacturer plans to boost production of electric heavy-duty trucks.

In addition to high prices, the availability of charging capacity is another challenge. Electric 18-wheelers need a significant amount of electricity to charge—each charger (what Tesla calls a Megacharger) can draw one megawatt of power or more, and some sites will need 20 to 40 megawatts of capacity. At these levels, new distribution circuits and new or expanded substations will be needed. Electric utilities, their customers, and regulators need to start working these needs into their distribution planning. In addition, some of the funds in the 2021 bipartisan infrastructure law for vehicle chargers should target charging for 18-wheelers. A coalition of manufacturers and environmental groups is urging a set-aside of at least 10%.

Electric vehicles are gaining momentum, but EV 18-wheelers will be challenging. To help grow this market, higher federal tax incentives for class 8 vehicles and strong vehicle efficiency standards are needed, in addition to private-market, utility, and policymaker attention to building out charging and power distribution infrastructure. With these steps, we can reduce the high proportion of greenhouse gas, NOx, and particulate emissions from heavy-duty trucks.