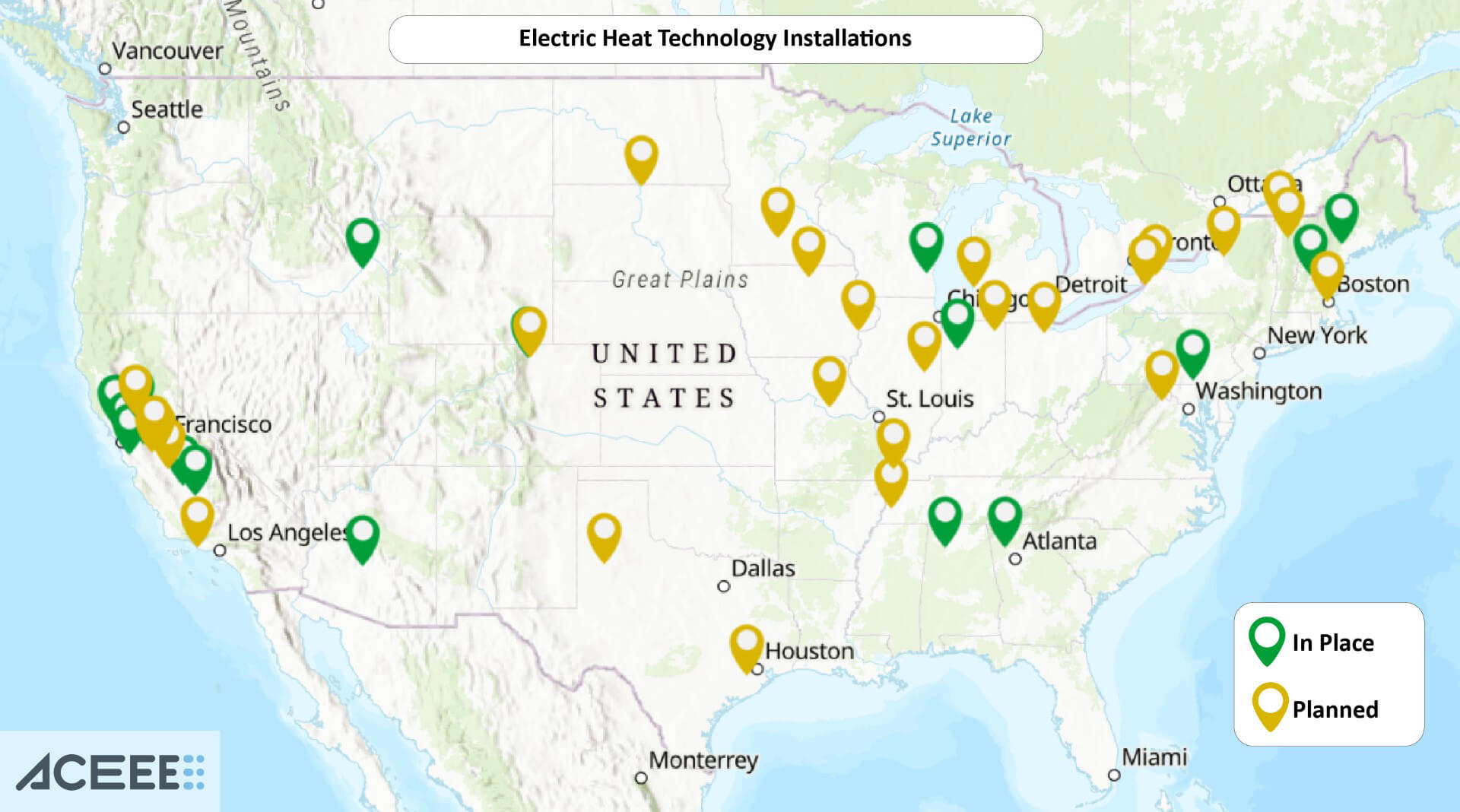

Our new interactive map shows dozens of installed and planned industrial electrification projects in the United States, demonstrating growing momentum in sectors including food and beverage manufacturing, chemicals, and lumber.

Electrification of many low- to medium-temperature processes can help manufacturers improve efficiency and stabilize and reduce costs. American manufacturers are beginning to adopt industrial heat pumps (IHPs) and thermal batteries but are being outpaced by global competitors. Examples of installations and data on their operations can help more companies considering electrifying take the next steps and can inform state and local policymakers seeking to accelerate adoption.

We mapped where IHPs and other electric industrial heat technologies are being deployed across the United States. Our map, the first of its kind, depicts a growing market with significant untapped potential that could be unlocked by incentives or other support to lower the barriers for entry.

The map shows electric heat installations at industrial facilities in the continental United States, including IHPs and thermal batteries; the latter convert electricity into thermal energy stored for later use. This map is not exhaustive, as we know of more than a dozen installations that are currently confidential. We plan to continue adding to this map as we become aware of new installations, and we welcome any additional submissions. We sourced map data from public information, partners, and stakeholders in the IHP supply chain.

The green markers indicate installed projects. Where possible, we include the vendor of the electric technology, its efficiency, the type of implementing facility, and the application. For some projects, these data are not publicly available or could not be shared with us.

The yellow markers indicate projects that are planned but have not yet been completed.

A few key factors help some industries and regions electrify faster than others

Generally, electric technologies have been installed in low- to medium-temperature applications where multiple factors converge:

- Low spark gaps (the ratio of electricity to natural gas prices). More projects advance in states with spark gaps of approximately 3–4 or lower, or with policies and programs to help address high electricity costs. Regionally, those areas broadly include the Pacific Northwest, Southeast, and mid-Atlantic.

- Significant efficiency improvements. Lower lifts (the difference between the heat source temperature and the delivered sink temperature) and optimized uses of waste heat result in higher efficiencies or coefficients of performance (COP). As COPs increase, payback periods decrease, boosting project feasibility. Applications co-located with other waste heat recovery opportunities, or those that have dual process heating and cooling needs, are generally more efficient.

- Opportunity to redesign thermal loads. IHPs and other electric technologies offer an alternative to often overdesigned boiler systems; right-sizing in this manner, especially for new builds, reduces electricity demand and saves costs and energy.

- Opportunity to deliver co-benefits. In addition to saving energy, IHPs and other electric technologies can provide benefits such as more precise controls and modularity, reduced insurance and permitting costs, and resource conservation to implementing facilities, which can improve project economics and reduce payback periods.

- Opportunity to leverage other technologies. There are multiple technologies that, when paired with heat pumps, can reduce project costs and increase flexibility. Thermal energy storage, for example, can enable load shifting and demand flexibility. Onsite generation of electricity can negate the need for costly electric infrastructure upgrades.

For example, a state like Pennsylvania—with a lower average spark gap (between 2 and 3)—provides an affordable setting for a lumber drying facility (see map) to electrify. In such applications, IHPs are typically coupled with traditional drying kilns to reduce energy use in the dehumidification process. In addition to saving energy, IHPs used in lumber drying improve end-product quality and remove commonly emitted pollutants.

The processes most common in our map include lumber drying, dairy processing, food drying, food processing, and cleaning-in-place (a process for cleaning equipment without disassembling) with hot water. However, these are not the only sectors and processes for which electrification is now possible; there are low- to medium-temperature applications across all industrial subsectors. Additional case studies, such as in chemical concentration and distillation or high-temperature steam production, could help increase manufacturers’ confidence in electrifying a wider range of processes. Our map includes only one chemical sector application, but we hope to see more in the near future.

Electrification at scale will require support from policymakers, utilities, and industrial companies

Even in states with high spark gaps, supportive policies can enable deployments. For example, our map includes seven installed projects and five planned ones in California, where industrial electricity prices in November 2024[1] were 2.4 times the national average. California’s Industrial Decarbonization and Improvement of Grid Operations (INDIGO) program and Food Production Investment Program (FPIP) have allowed companies in the state to access funds to mitigate the capital costs of upgrades. Other states can implement similar policies to help their industries access the cost and energy savings that electrification affords.

Electric utilities and their regulators have the option to redesign rates for industrial customers to support greater electricity consumption, especially for customers who can provide flexible load. They can also directly incentivize the implementation of IHPs. Research, development, and deployment of other key technologies, such as thermal energy storage, will also be critical for ensuring that electrification projects are economically viable.

For additional recommendations on supporting industrial electrification, see our recent topic brief.

This post has been updated (2/27/25).

[1]The most recent month for which we have data from the Energy Information Administration.