LED light bulbs have transitioned from a fledgling technology to a major market player in recent years, with more than 450 million installed nationwide as of 2016. With Americans increasingly choosing LEDs, and federal standards set to increase efficiency levels for general service lamps (the most common type of screw-in light bulbs) in January 2020, many utilities and regulators are wondering whether it is time to leave residential lighting programs behind as they plan for the coming 2019–2021 program years.

Do the upcoming standards mean residential lighting programs will no longer be cost-effective? Or can programs gain another year or two of savings by promoting efficient light bulbs, which have long been the mainstay of residential program portfolios? These questions are at the forefront of utility program planning and regulatory agendas in many states. We find that for 2019, utility programs can achieve savings in most states by continuing to run programs for the full range of LED lamps. But the picture is more complicated for 2020 and 2021, and regional differences will also matter.

LEDs are gaining ground, but the race is not over

Overall, according to the National Electrical Manufacturers Association, LED lamps accounted for 36% of national light bulb sales in the fourth quarter of 2017, while halogen lamps still held 48% of market share. While the growth in LED market share is promising, these LEDs are largely displacing CFLs. The market share of halogens and conventional incandescents—both of which are much less efficient—has held steady, hovering close to 50% of sales since the end of 2014.

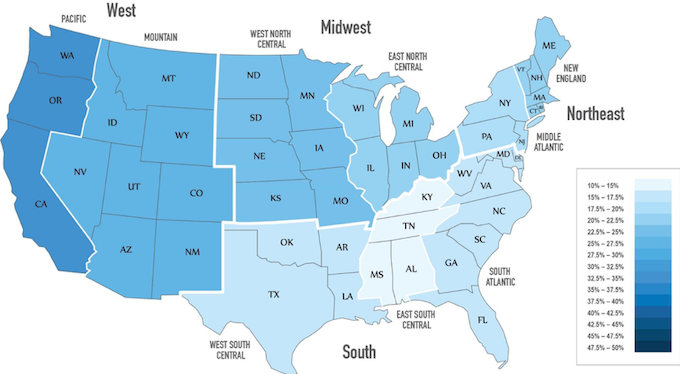

LED adoption varies across the states and even within states depending largely on the presence of successful lighting programs and the mix of retailers. For example, state standards are accelerating the transition even further in California. The map below shows LED market share by census region and highlights the striking differences across the country. Many states still haven’t reached 20%, while a small number of leading states have exceeded 40%.

2015–2016 LED Bulb Sales (as a percentage of other bulb technologies sold)

Source: EPA

Even in states where LED market share is already high (greater than 40%), continued investment in residential lighting programs is critical. Early evidence from New York and Massachusetts suggests that LED adoption slows when program activity is scaled back, arguing for continued promotion rather than premature retreat. Targeted programs that address specialty products may be a good fit for these states. For others, there are still cost-effective opportunities for utilities—if not for a full three-year program cycle, at least for a portion of the cycle.

What a difference a year makes

For many states, 2019 looks very much like 2018 or 2017. New federal standards have yet to take effect and consumers continue to find a wide range of inefficient halogen and specialty incandescent lamps on store shelves. For 2020, the situation is much less clear. When the new standards come into effect on January 1, 2020 it will no longer be legal to sell most halogen and incandescent light bulbs, but there are several factors that could affect the initial implementation of the standard:

- Legal uncertainty: While there is still some legal uncertainty regarding implementation of the 2020 standard, ACEEE and others are fairly confident the new 45 lumens per watt (lpw) standard will go into effect.

- Sales prohibition: Unlike other federal standards, the federal backstop language triggering the lamp standard prohibits all sales of non-complying products as of the effective date. Virtually all other federal standards apply to the manufacture or import of products rather than sales, allowing for a transition period as retailers are allowed to sell their remaining stock of non-compliant products. This unique provision shifts enforcement to retail, creating uncertainty about the specifics and rigor of the enforcement process.

- Product categories: The original standards for general service lamps enacted in the Energy Independence and Security Act of 2007 (EISA), along with the 2020 backstop provision, covered the most common screw-based lamps. DOE has since expanded the definition and extended coverage to many lamps that were originally exempted from standards.

Rather than pre-determining the final fate of programs while the transition plays out, programs should take more of a “wait and see” approach. Program administrators should closely track market conditions in their territory and make final program decisions for 2020 in the fall of 2019, and hold off on final decisions for 2021 until the fall of 2020. By 2021, we expect that many of these transition issues will be resolved, and as the market shift to LEDs progresses throughout the country, it is likely that residential lighting programs will no longer be cost-effective beyond 2021. The residential lighting market will have transformed from an incumbent technology, largely unchanged for more than 100 years, to an entirely new technology with unprecedented speed—a major energy efficiency success story.

Program opportunities

In the near-term, utility programs can achieve savings in most states by continuing to run LED promotions and incentives for the full range of LED lamps. There are also promising near- and mid-term opportunities for residential lighting programs, especially in states where LED sales are relatively high. Options include:

- Underserved markets: While national home improvement and hardware chains offer a robust mix of LED products and boast strong sales, a 2017 Consumer Federation of America study found smaller independent, grocery, and discount stores are less likely to stock and promote a range of LEDs. This is particularly true for those serving rural and lower-income urban neighborhoods. Programs can find additional savings by targeting rural, elderly, and low-income market segments that have been slower to adopt LEDs.

- Specialty lamps: Manufacturers have introduced LED versions of the most popular styles of specialty lamps including decorative, candelabra, globe, and reflector lamps, but market share for these lamps continues to significantly underperform general purpose LED lamps.

- High quality lamps: An increasing number of “value” LED lamps are hitting the market, but while they boast similar efficiency to ENERGY STAR®-qualified lamps, they are typically shorter-lived and do not meet the quality and performance criteria required for ENERGY STAR certification. Programs should consider continuing to promote high performance ENERGY STAR branded products.

- Controls: Dimming and occupancy controls offer additional savings opportunities. Programs should consider promoting quality control solutions that are easy to install and operate to assure consumer acceptance and persistence.

Beyond lighting

While there is still some life left in residential lighting programs, most of these programs will end in a few years. Programs must turn their attention to new opportunities to expand and diversify their residential efficiency programs. ACEEE has identified a number of promising opportunities that can help fill the gap left by lighting programs. Smart technologies, including smart thermostats, offer a new area for energy savings. Other opportunities include advanced HVAC and water-heating technologies (including improved HVAC installation and maintenance), efficient and better-controlled plug loads, and more. Energy efficiency has a leading role to play in providing targeted, low-cost savings in a distributed energy future.