Part Two in a series where ACEEE examines the most effective roles for energy efficiency programs and market-driven solutions in scaling deployment of energy efficiency. Click here to read Part One.

Last week, I wrote about the false dichotomy between energy efficiency programs and market-driven solutions, pointing out the successes and limitations of market-based solutions. We should encourage the private market where it works well, experiment with new market-based approaches in other promising market segments, but also continue to use other proven approaches, such as utility and state energy-efficiency programs, particularly for market segments where the success of market-focused approaches has yet to be proven. In this post I summarize research on the role of market-focused programs over the past few decades. In the final installment next week I will look at recent developments and potential opportunities ahead.

As philosopher and essayist George Santayana wrote in The Life of Reason (1905), “[t]hose who cannot remember the past are condemned to repeat it.” Things can and do change, so the past is far from an absolute guide to the future, but understanding the past is useful so we can better plan paths forward.

The recent history of market-based energy efficiency

There was a major push toward market-based approaches to delivering energy efficiency in the 1990s. ACEEE reviewed the success of these efforts in a 2001 report, which interviewed more than a 100 energy service companies, retail electricity service providers and distribution utilities. The research concluded that:

- While energy service companies played an important role, they tended to reach primarily institutional and large commercial customers and showed little interest and ability to serve residential and small business customers. They also had difficulty serving industrial markets.

- At the time, the competitive retail electricity suppliers had not demonstrated themselves to be effective vehicles for achieving energy efficiency improvements, due to a number of challenges, including: a high failure rate among supplier firms, a mixed interest in energy efficiency among suppliers, a lack of competitive electricity suppliers actually marketing tangible energy efficiency measures, and a lack of customer interest in obtaining energy efficiency from competitive suppliers.

- Absent legislative or regulatory requirements, there was strong evidence that in a restructured electric industry, utility companies would not choose to provide substantive energy efficiency programs. If they provided anything at all, they were more likely to provide minimal "information" type programs, largely as a customer service and customer relations mechanism.

Similarly, in the 1990s some electricity markets were deregulated based on the theory that retail competition among power providers would lower costs and improve service (both energy efficiency and other services). MIT economist Paul Joskow reviewed these efforts in 2003 and found that “the performance of retail competition programs has been disappointing almost everywhere, especially for residential and small commercial customers.” This should serve as a cautionary tale, particularly for services for residential and small business energy consumers.

Financing

Likewise, some observers have suggested greater reliance on financing options, such as loans, rather than incentives. Financing is an important and useful tool, but while some customers will take out loans, others will not, for a variety of reasons ranging from poor credit rating, aversion to debt, or accounting procedures which make “on the books” financing difficult for some companies. The limitations of loan programs are documented by a 2011 ACEEE report that looked at many of the leading energy efficiency loan programs around the country, operated by a variety of organizations (including utilities, states, non-profit and for-profit organizations and financial institutions) and found only two that had served more than 5% of eligible participants. Limited interest in energy efficiency loans is confirmed by reports from private small lenders convened as part of ACEEE’s Small Lender Energy Efficiency Community (SLEEC).

Also, if funds available for incentives are limited, past experience indicates that most customers prefer direct rebates to subsidized loans. For example, Wisconsin Electric and Puget Power in the 1980s found that when commercial customers were offered a choice of a zero-interest loan or a rebate of the same value, over 90% chose the rebate (see p.158-159). There are older studies on residential customers that found 15-49% of customers preferred subsidized loans, with the rest preferring grants equal to the loan subsidy. If the goal of customer-funded efficiency programs is to reach the broad base of energy customers, financing efforts can’t be the only or even the primary tool for achieving that goal.

The cost problem

There is also a question of whether relying on the market will raise or lower costs. In the 1990s and early 2000s there were experiments in which bids were solicited for energy efficiency improvements and the least expensive viable options were chosen. Likewise there were “standard performance contracts” in which standardized incentives per kWh and/or kW-saved were offered to energy service companies and other private firms. In these efforts there was a tendency to get only certain types of savings, and for the prices to be relatively high. Specifically, the bids received tended to emphasize projects at large commercial and industrial facilities, with little for small businesses and only a modest amount for residential customers. The service providers targeted the largest customers because these customers provide large savings per successful marketing effort. Marketing costs tend to be high when you need to recruit many small customers and as a result most private sector energy efficiency firms have shied away from the small business market.

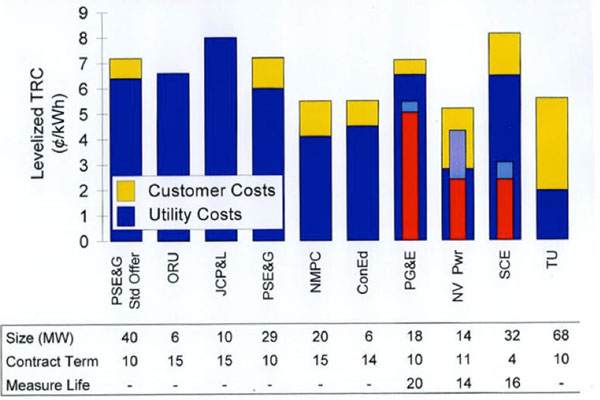

With bidding programs, the firms quickly learned what the market-clearing price was likely to be and then bid just below it. As a result, as shown in the graph below compiled by Lawrence Berkeley National Laboratory, the bidding and performance contracting programs ranged in cost from about 5.5 to 8 cents/kWh saved. The average ratepayer-funded energy efficiency program had a total cost of about 4.4 cents/kWh saved, according to a report by Lawrence Berkeley National Laboratory, when both program administrator and customer costs were included. In other words, the bidding programs have tended to be more expensive, not less. Not all market-based efforts will cost this much, but to date, evidence is lacking that market-based efforts will cost less.

Cost per kWh Saved of U.S. Demand-Side Bidding and Standard Performance Contracting Programs

Source: Chuck Goldman, Lawrence Berkeley National Laboratory, presentation to the Oregon Public Service Commission. http://www.puc.state.or.us/meetings/pmemos/2012/040512/Goldman.pdf. The red and light blue inner bars are the costs per kWh if the analysis includes savings for the full measure life and not just the contract term.

Cream skimming

In addition to concerns about costs, past experience indicates that left to their own devices, many private sector firms will tend to do "cream skimming." For example, a Lawrence Berkeley National Laboratory study on the results of bidding found that these efforts emphasized lighting measures. These tended to be low-cost measures with a high return on investment, but that also only scratch the surface of cost-effective efficiency options. To address this, some programs established lower ceiling prices for lighting than for other measures, in order to encourage a diversity of approaches.

There are some markets where private suppliers of energy efficiency have done well, but many others where the success of market-only approaches has been limited. Financing approaches are useful because they can leverage private capital, stretching energy efficiency program funds further, and have proven useful for some customers. But the past indicates that markets alone will likely only reach a minority of customers, and only with some energy efficiency measures. Much more energy efficiency can be delivered if markets and energy efficiency programs work together.

Next, in the third blog in this series, I will talk more about paths forward, with an emphasis on recent and potential near- and medium-term developments that could potentially allow us to improve upon the results from the past. I will discuss areas where markets can lead and ways that markets and programs can work together to maximize positive synergies.